Takaful is a Sharia-compliant Islamic insurance product, where members of the community contribute money or a part of their earnings to a pooling system that guarantees against any loss or damage. The underlying principle of takaful portrays the responsibility of each to cooperate and protect each other.

The drivers of Takaful demand include high economic growth and increase in per capita GDP, a youthful demography, increasing awareness, a greater desire for shariah compliant offerings and increasing asset based, shariah compliant financing.

Global Takaful Islamic Insurance Market Research provides an in-depth assessment of Takaful Insurance, including key market trends, upcoming technologies, industry drivers, challenges, regulatory policies & strategies.

The global market share of the Takaful reaches the value of 27.6 billion dollars in 2020.

Takaful Industry experts have forecasted that Islamic Insurance market share will grow up to 14.6%, and market share will be approximately $97.17 billion from 2021 to 2030.

Takaful is mainly gaining momentum around the world in the Asia Pacific and the GCC region.

Based on market share, the GCC region is considering having its more incredible boost in the past decade among the Muslim Nations. Countries like Saudi Arabia, United Arab Emirates (UAE) and Malaysia are predicted to be the high growth markets in this region. Other areas include Southeast Asia, eastern and western African countries, which are also playing a considerable role in the growth of the Takaful Industry around the globe.

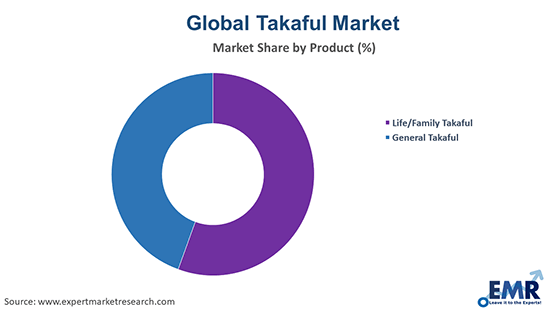

Takaful Industry distinguished into General and Family Takaful, market participation of family Takaful is more than general Takaful.

The primary distribution channels for Takaful are;

- Takaful Companies

- Window operations of Insurance companies

- Broker firms

- Banks

Across the globe, 47 countries operate in Takaful (Islamic Insurance), and Only 22 countries have Islamic financial regulations to operate in Takaful.

According to Global Market research, there are enough products as its participation is only 2% to the global Islamic financial assets. The primary need is about introducing existing products suitably and productively for the growth of the Industry.

Around 350 companies are dealing in the Takaful business, and in this Industry, there is ample scope for new opportunities and entrance into the emerging concept of Islamic Insurance.

The changing regulation, growing affluence, and growth in organized savings amongst the local customers are the key drivers for the growth of the takaful market in this region.